DAOs in the financial services sector: By Jonny Fry

Posted on by Jeremy Barnett

DigitalBytes November 2022

The term ‘decentralised autonomous organisation’ (DAO) refers to a new type of legal structure in which no single leader or board of directors is responsible for making decisions. DAOs are popularised by crypto enthusiasts for their bottom-up style of operation which arguably offers greater transparency as procedures and rules are codified using technology, such as smart contracts. The day-to-day management of a DAO is much more collaborative in style, less autocratic and, in theory, less subject to poor individual executive decisions.

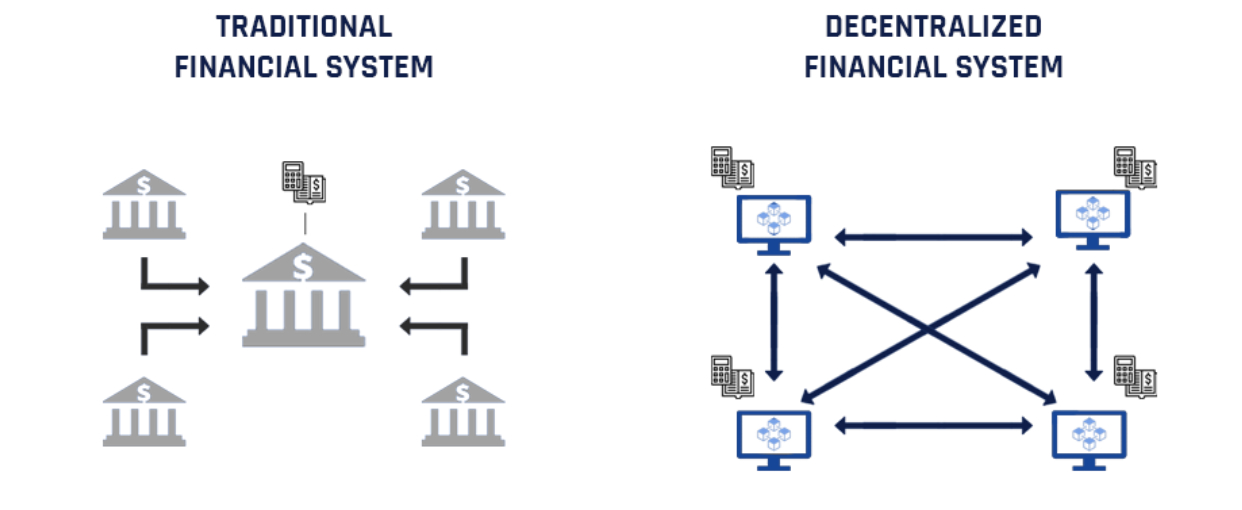

Decentralisation is a crucial aspect of digital assets and digital currencies which themselves are dispersed across numerous computers, networks and nodes rather than under the command of a centralised organisation such as a government or bank. Virtual currencies are established to take advantage of decentralised structures thus providing their users with greater anonymity, improved levels of transparency and security in their transactions than is possible with conventional assets. In 2016, a group of developers was inspired by the decentralised nature of cryptocurrencies to create the concept of a DAO. One of the goals of a DAO is to make it easier to offer more transparency and to ensure that the organisation is less susceptible to fraud, bribery, duplicity, etc, in terms of the way that an organisation is managed. However, a DAO is only as good as its initial structure and ethics – i.e., can a small group have a disproportionate impact on any of the ongoing decisions and on the DAO’s participants?

Financial markets – decentralised v traditional

(Source: Stably)

Advantages of DAOs

A few scenarios exist where an organisation or group of people could aspire to adopt a DAO structure, with advantages of this management style being:

· decentralisation: individuals, rather than a central authority outnumbered by its peers, make decisions that influence the organisation. By distributing decision-making power amongst many users, a DAO eliminates the need to rely on the decisions of a single person (e.g., the CEO) or a small group of people (Board of Directors).

· participation: when employees have a voice in their employer’s decisions, they can feel more invested in the organisation. A DAO enables token holders to vote, burn tokens or utilise them in ways they think are beneficial for the company, even if these individuals do not have much voting power.

· publicity: votes cast inside a DAO are recorded (typically on a blockchain) and made available to all members. This hopefully encourages users to act in a more responsible and ethical manner, as everybody can see their votes and selections. The intention of this added transparency encourages voters to engage in matters that are good for their reputations and discourages them from doing something that will harm the community.

· community: the DAO model facilitates co-operation amongst individuals from different locations as members may connect with other members from any site via an internet connection.

DAO constraints

Despite their promises, DAOs are not without flaws. Setting up or operating a DAO incorrectly might have devastating effects. The DAO structure has the following restrictions, including:

· speed: one vote may be sufficient for a public corporation to decide on a particular action or course of action. Every participant in a DAO has one voice. Taking into account time zones and priorities outside the DAO necessitates a lengthy voting session.

· education: parallel to the time ‘crunch’, a DAO must inform a much larger audience of impending entity behaviour. Compared to the stakeholders of a DAO (who can have varying levels of knowledge and understanding of initiatives, incentives or access to resources), a single CEO can easily remain up to date on corporate developments. Whilst DAOs have the potential to unite individuals from all walks of life, one of the biggest challenges they face is ensuring everyone learns to work together and grows as a team.

· apathy: non-voting of shareholders is a real challenge for quoted companies. As reported by the Investors Chronicle in the UK, Mark Northway, a ShareSoc director, states: “We think that only between 1 and 6 per cent of individuals’ shares get voted at the moment.” There is no reason why members of a DAO will be more actively engaged with ongoing decisions.

· DAOs have a high potential for inefficiency: it is easy for a DAO to spend more time talking about changing things than actually accomplishing them. The necessity of co-ordinating larger numbers of people increases the risk that a DAO may become mired in mundane administrative activities.

· security: blockchain resources on any digital platform have the inherent risk of hacking. Votes and choices made inside a DAO need considerable technical skills in order to be implemented – without them, they may be invalid. If users cannot trust the organisation, they may abandon it. DAOs may be abused, treasury reserves taken and vaults emptied – even with multi-signature or cold wallets.

How can DAOs help banks?

DAOs can help banks solve common issues and simplify internal operations by shifting to the blockchain. Banks are extremely centralised, making them vulnerable to corruption, fraud and mismanagement. DAOs’ decentralisation, openness and security might serve to solve these challenges. Distributed ledger technology (DLT)-based DAOs for banks and financial institutions can provide safe and efficient services without physical infrastructure. DAOs’ transparency and decentralisation might ensure banks and financial organisations are more responsive to clients and, with the transparency offered by a DAO, this may help to restore trust in firms in the financial sector. A report from Ernst and Young found that. “24% of respondents identify PayPal, a FinTech, as the most-trusted financial brand — more than double the figure of the closest bank.” The COVID-19 epidemic has undoubtedly accelerated banks’ digital transformation and many banks are now using fintech to solve issues. So, DAOs can also benefit customers.

DAOs and their effect on financial institutions

If DAOs become common, they will significantly impact how banks and other financial institutions are run. The financial services sector is becoming more and more digitised. An example of this is NuBank, the largest ‘neo’ bank in the world with 45+million customers. DAOs can help rebuild trust in financial institutions and putting DAO governance ideas into banks could be the missing link that combines technology and traditional financial institutions. Furthermore, DAOs can help banks expand into untapped sectors and types of customers. Banks, for example, do not take enough action to meet the needs of the remittance industry. Banks could reach these people with new services and products by using the transparency offered by a DAO structure.

Is there a way that advisors and investors may benefit from DAOs?

Investment management and client-advisor interactions will likely change as a result of DAOs. Smart contracts can make it easier for investment managers to track performance, make sure rules are followed, distribute income payments or return capital. By doing so, advisors will have more time to focus on providing additional value to their customers. DAOs offer the ability for all investors/clients to have a say and, in a strange way, it could be argued that DAOs are not actually new but a return to a more collaborative style of managing organisations – not dissimilar to co-operatives, credit unions, mutual insurance companies and building societies (these such organisations were run by members for the benefit or the members). As the cost and complexity of compliance rises, could DAOs indeed been seen by regulators as an alternative way for some parts of the financial sector to be fashioned? It is rather ironic that the DAO movement, sparked by a desire to move away from a centralised structure, could find a champion in regulators, who tend to be highly centralised as they typically like to be able to hold individuals to account!!

https://teamblockchain.net/